Mumbai, October 3, 2018 – The insurance technology (InsurTech) sector is booming and facilitating a new era of collaboration between challengers and insurance industry incumbents, according to the inaugural edition of the World InsurTech Report 2018 published today from Capgemini and Efma.

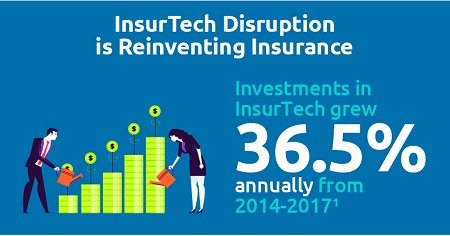

The World InsurTech Report 2018 finds that insurance executives across the industry believe that InsurTechs will be a major catalyst to redefine the customer experience, deliver widespread efficiencies, and create new business models. The industry also expects disruption and new competition to come from BigTech companies and manufacturers. This comes in the wake of an InsurTech sector that saw investment increase at a compound annual growth rate of 36.5 percent between 2014 and 2017.

The Industry is Transforming

By common consent, InsurTech firms are having a transformative effect on the industry. Asked about the current and potential impact of InsurTechs, 67.1 percent of incumbent insurers said they could ‘redefine customer experience’ (with 91.7 percent of InsurTech executives agreeing), while 36.7 percent said they could ‘bring in new business models’ and 35.4 percent felt that InsurTechs would ‘enhance incumbent insurers’ capabilities. InsurTech respondents agreed at (58.3 percent and 33.3 percent respectively).

Collaboration is the focus

Almost 96 percent of insurers said they were looking to collaborate with InsurTech firms in some way, with a partnership and Solution-as-a-Service (SaaS) approach widely favored. The vast majority (77.9 percent) said that ‘partnering to develop a new solution’ was their preferred approach. A similar majority (75.8 percent) said they wanted a SaaS approach to engaging with InsurTechs. By contrast, only up to a third (32.6 percent) said they were considering acquisitions.

When asked about the benefits of collaboration, 77.2 percent identified ‘improved ability to enhance customer experience’, 59.5 percent ‘faster time to market’, 46.8 percent ‘new digital capabilities,’ and 40.5 percent ‘competitive advantage over peers.’ InsurTech categories that are being considered for short-to-medium partnerships include data specialists (identified by 62 percent of incumbents), claims management solution providers (51.9 percent), front-office solution providers (51.9 percent), and technology specialists (55.7 percent).

“It’s clear that insurers and InsurTechs see collaboration as the key to success in the evolving industry ecosystem, with re-imagined customer experience at its heart. Finding the right chemistry between collaborators to create a sustainable, agile position in the industry is the key to determining who will be future industry leaders,” said Anirban Bose, CEO of Capgemini’s Financial Services Strategic Business Unit and Group Executive Board member.

In parallel with the rise of InsurTechs, traditional insurers believe that a new wave of competition is likely to come from a combination of manufacturers and BigTech firms. Among incumbents, 81 percent identified Amazon as the primary source of potential competition, with 59.5 percent pointing to other BigTechs (such as Alibaba) and manufacturers. “New competition requires incumbent insurers to be agile and innovative. Collaboration with the right InsurTech partner will facilitate the journey to attain the right position as industry disruption continues,” said Vincent Bastid, Secretary General of Efma.

World InsurTech Report 2018, Report methodology

The World InsurTech Report 2018 (WITR) covers all three broad insurance segments: life, non-life, and health insurance. This year’s report draws on research insights from two primary sources – surveys and interviews with traditional insurance firms and InsurTech firms. This primary research together covers insights from over 140 executives across 33 markets.

Download Full World InsurTech Report 2018 PDF REPORT