Chief Financial Officers (CFOs) are busy trying to project and maintain revenue and profit for the current year facing coronavirus pandemic crisis. According to a recent Gartner survey, between 14th to 19th April 2020 of 99 CFOs, and financial leaders, data showed that 42 percent of CFOs are not incorporating for the next wave coronavirus outbreak into any of their scenarios.

Survey responded data also revealed that only 8 percent of CFOs have a next wave factored into all their further planning scenarios. Only 22 percent of CFOs have a next wave factored into their “most likely” scenario. The lack of planning gets even as CFOs express a careful strategy as to when they will fully re-open their business operations and get employees back to their regular job habits.

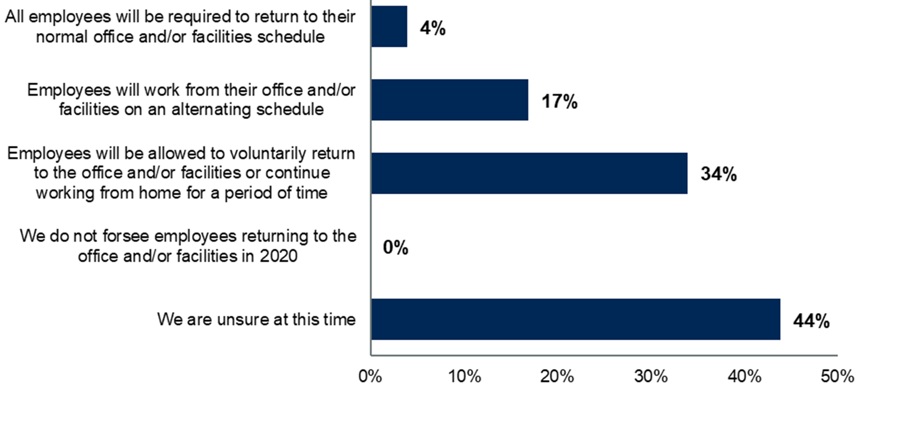

While 81 percent of CFOs responded that they would look to state and local authorities for clarification on when to resume their business operations. 55 percent of CFOs reported that they would take a systematic approach as to when their employees will rejoin the work. 44 percent of CFOs are unsure of how employees will re-join the office.

For employees who are not working from their normal office, once their offices are re-opened, how will employees be brought back into work (Data Source: Gartner- April 2020 Survey)

Increasing concern among CFOs about the coronavirus pandemic’s duration, severity, and associated macroeconomic implications may be adding to a disconnect between when CFOs understand that they are allowed to reopen their offices, compared with their particular plans for accelerating employees return to the offices.

Some CFOs seem to be conscious of going forward too quickly, with only 4 percent of CFOs responded that their organizations would require employees to join office immediately, even after receiving government order to open offices.

Concerns About Revenue Decline, As COVID-19 Concerns Mount

Although the lack of contingency plan for the next wave of coronavirus outbreak, CFOs have become more serious about the impact of coronavirus and its risks, with CFOs citing “macro-pandemic concerns” as their first concern at more than double the rate they did at the starting of April. These concerns have risen while fears about revenue, losses, and employee-related issues, like as productivity losses and meeting payroll, have declined.

The concerns about the significant picture implications of the coronavirus pandemic have grown to tie cash flow worries as the top concern cited by CFOs in April in this crisis, with each category selected by 28% of the CFOs surveyed.