Palo Alto Networks has completed its acquisition of CyberArk, marking one of the biggest cybersecurity deals this year. The $25 billion transaction puts identity security at the center of Palo Alto’s platform strategy.

According to the agreement, former CyberArk shareholders will get $45 in cash and 2.2005 shares of Palo Alto Networks stock for each share they owned. This mix of cash and stock is meant to provide both immediate value and future growth potential.

Identity security has long been key to stopping breaches, especially when attackers take advantage of weak credentials or too many privileges. CyberArk, founded in Israel and listed on NASDAQ as CYBR, is known for its strong privileged access management and identity protection solutions for cloud, hybrid, and enterprise systems.

Why the Deal Matters

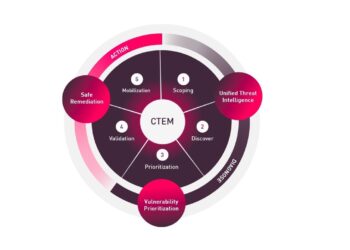

Palo Alto Networks, a leader in network security and cloud protection, has focused on building a unified cybersecurity platform by combining different technologies for network, cloud, operations, and now identity. By acquiring CyberArk, the company wants to remove “identity silos” that have made access control and incident response more difficult in the past.

With the rise of AI agents, automated systems, and machine identities, the number and complexity of potential attack points have grown. There are now far more machine identities than human ones, giving attackers more chances to exploit unused credentials and incorrect privilege settings. This acquisition aims to address these new threats by making identity security a core part of Palo Alto’s offerings.

Nikesh Arora, Chairman and CEO of Palo Alto Networks, said that joining forces with CyberArk will help customers manage privileged access in hybrid cloud environments more efficiently and securely. This partnership aims to avoid fragmented controls and speed up breach detection and response.

What Comes Next

Now that the deal is complete, Palo Alto Networks plans to add CyberArk’s identity platform to its current products, but will also keep it available as a separate option for customers who want dedicated identity controls. Technical integration has already started, focusing on better operational resilience and stronger security results.

As part of the acquisition, Palo Alto Networks plans to seeka secondary listing on the Tel Aviv Stock Exchange (TASE) using CyberArk’s ticker symbol, “CYBR.” If this happens, Palo Alto Networks would become one of the largest companies on the Israeli exchange, highlighting CyberArk’s origins and the value of linking innovation across regions.

Market and Industry Impact

Analysts see this deal as a major step in the growth of cybersecurity platforms. By combining identity security with network and cloud protection, Palo Alto Networks aims to help organizations handle more advanced attacks, including those using AI and fast-moving threats.

Also Read: 5 Future-Ready Skills Every Storage Engineer Should Build in 2026