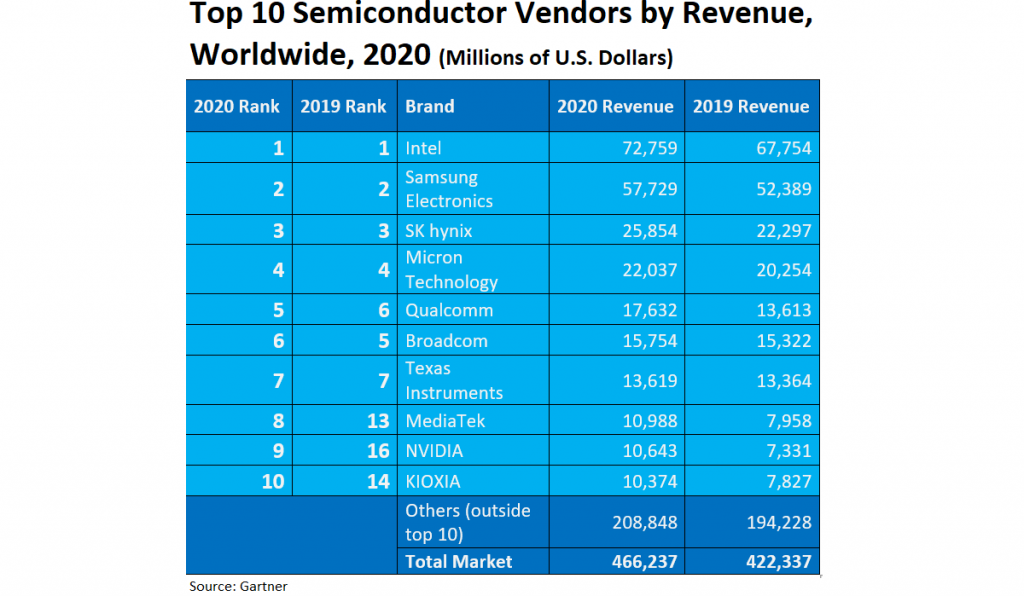

In 2020, due to COVID-19 outbreak, businesses faced difficulties maintaining their workflow, operations, cash flow. Companies minimized, held, or delayed the spending. Despite these, semiconductor revenue generated hyper-scalelion in 2020, a hike of 10.4% from 2019, according to Gartner’s final results.

Mainly memory, GPUs, and 5G chipsets drove semiconductor revenue growth in 2020, driven by hyperscale, PC, ultramobile, and 5G enabled handset end-market demand.

Intel maintained its rank as the No. 1 global semiconductor vendor by revenue in 2020, followed by Samsung Electronics, SK hynix and Micron. Intel’s semiconductor revenue grew 7.4%, driven by its core client and server CPU businesses.

Overall, the top players in the top 10 were NVIDIA and MediaTek. NVIDIA’s 45.2% growth was primarily driven by the company’s gaming-related and data center businesses. MediaTek’s revenue grew 38.1% in 2020, driven by the disruption to Huawei’s business throughout the year.

Memory Accounted for One-Third of Revenue Growth

Memory, which valued 26.7% of semiconductor sales in pandemic condition 2020, was the second best-performing device category, experiencing a 13.5% revenue increase. NAND flash experienced the best performance within memory with revenue growth of 25.2% due to a shortage in 1H20.

“Memory benefited from the key trend in 2020 — the shift to home working and learning — which fueled increased server build from hyperscale vendors to satisfy online working and entertainment, as well as a surge in PCs and ultramobile,” said Andrew Norwood, research vice president at Gartner.

Source: Gartner

Also Read: India Server Market Revenue Fell YoY by 11.2% in Q4 2020