Digital transformations enabling products and services strengthening businesses around the world, it brings new opportunities to organizations. To become competitive, organizations are increasing their spending towards digital transformations, adopting new products and services. Latest IDC report data shows significant increase of investments towards digital transformation. Expected investment will reach $1.2 trillion in 2019, approx 18% increase over last year.

IDC’s Analyst and program vice president Eileen Smith Said,” Worldwide digital transformation technology investments are expected to total more than $6 trillion over the next four years, Strong digital transformation technology investment growth is forecast across all sectors, ranging between 15% and 20%, with the financial sector forecast to be the fastest with a compound annual growth rate (CAGR) of 20.4% between 2017 and 2022.”

Majorly industries two industries discrete manufacturing and process manufacturing will invest most towards digital transformation, These two industries are on top list with approx investments $221.6 billion and $124.5 billion.

Retail will be the next largest industry in 2019, followed closely by transportation and professional services. Each of these industries will be pursuing a different mix of strategic priorities, from omni-channel commerce for the retail industry to digital supply chain optimization in the transportation industry and facility management – transforming workspace in professional services. A CAGR of 21.4% will enable the professional services industry to move ahead of transportation in terms of overall digital transformations spending in 2020.

Digital transformation is quickly becoming the largest driver of new technology investments and projects among businesses, It is already clear from our research that the businesses which have invested heavily in DX over the last 2-3 years are already reaping the rewards in terms of faster revenue growth and stronger net profits compared to businesses lagging in digital transformations initiatives and investments.

The Digital Transformations use cases –

discretely funded efforts that support a program objective – that will see the largest investment across all industries in 2019 will be autonomic operations ($52 billion), robotic manufacturing ($45 billion), freight management ($41 billion), and root cause ($35 billion). Other use cases that will see investments in excess of $20 billion in 2019 include self-healing assets and augmented maintenance, intelligent and predictive grid management for electricity, and quality and compliance. The use cases that will experience the greatest spending growth over the 2018-2022 forecast period are virtualized labs (108.6% CAGR), digital visualization (53.5% CAGR), and augmented design management (43.9% CAGR).

From a technology perspective, hardware and services investments will account for more than 75% of all digital transformations spending in 2019. Services spending will be led by IT services ($154 billion) and connectivity services ($102 billion). Hardware spending will be spread across several categories, including enterprise hardware, personal devices, and IaaS infrastructure. digital transformations -related software spending will total $253 billion in 2019. The fastest growing technology categories will be IaaS (35.9% CAGR), application development and deployment software (26.7% CAGR), and business services (26.5% CAGR).

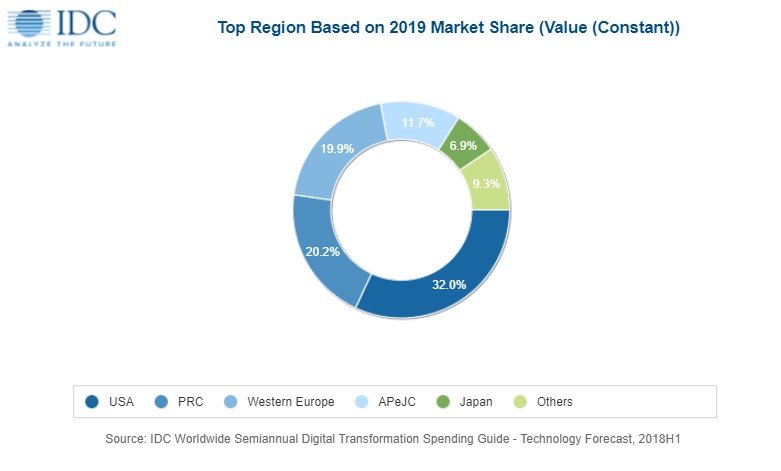

Report shows US and China will be major countries leading digital transformation spending in 2019, These two will deliver more than 50% of total worldwide. US leading industries will be discrete manufacturing with approx $63 billion, Professional services with approx $37 billion and transportation with $ 34 billion- these digital transformations spending will be on IT services, applications, software, and enterprises hardware.

While China leading spending industries will be discrete manufacturing with $55 billion, process manufacturing with $31 billion and state/local government with $21 billion. These digital transformations spending categories will be on connectivity services and enterprise hardware.